Let's talk about GameStop. Robinhood just shut down trading in the stock, because hey, capitalism is great, but let's not get carried away here. Rich people are taking a bath, and we can't have that!

You probably know GameStop as that grotty video game store in the basement of the mall. Have you been to the mall lately? No? Well, therein lies the problem, we mean the OPPORTUNITY! Hedge funds, i.e. rich guys who get paid by other rich guys to hold their money and invest it in ways that are riskier than your average mutual fund, bet that GameStop stock would continue to go down as we all stayed home and let the internet bring the amusement to us.

The hedge funds shorted the stock, meaning they borrowed shares from a broker to sell in the short term, with the express intention of buying them back when the stock goes down and pocketing the profit. There's nothing illegal about it, but let's not sugar coat it: These are sophisticated investors making a bet that someone dumber than they are will pay more than the stock is worth. So they borrowed A LOT of shares — 71.2 million, to be exact, even though the company only has 69.7 million shares outstanding.

Enter the "Dumb Money," i.e. the individual investors, whose traditional role is to be the rube on the other side of that short transaction. (Yes, there were also institutional investors betting that GameStop would go up. But let's not get distracted here.) Thanks to technology and platforms like E-Trade and Robinhood, the Dumb Money can now do almost everything the big guys can do — they can buy and sell stocks in cheap, frictionless transactions without going through a broker, they can short stocks with a couple of mouse clicks, and they can talk about it on social media in ways that move the market without having to get themselves booked on CNBC.

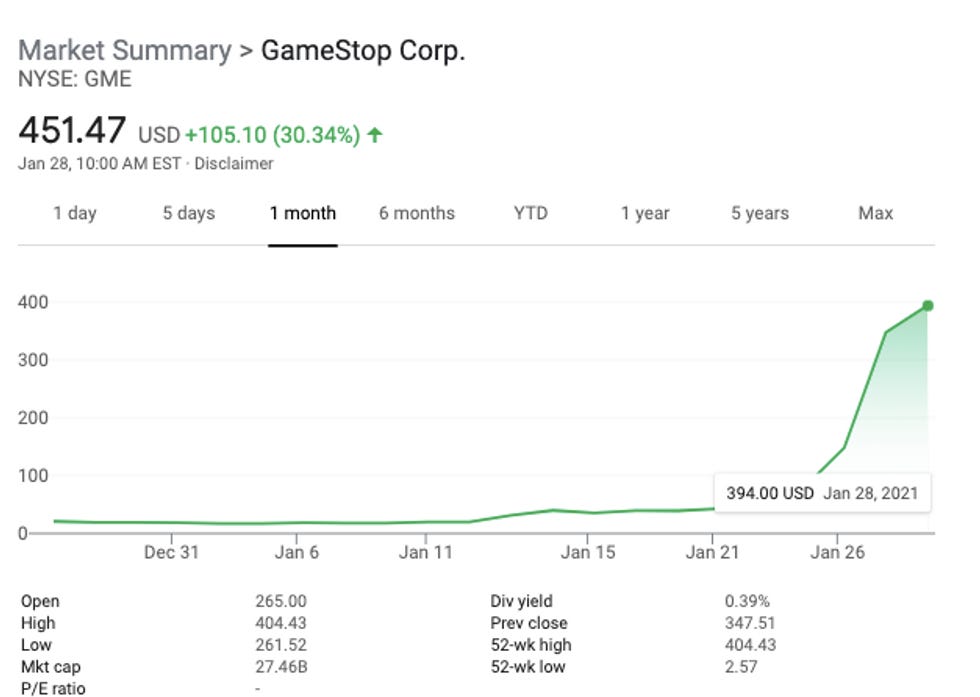

A bunch of Dumb Money got together on a Reddit forum called r/WallStreetBets , and they decided GameStop was GOOD. They started hyping the stock and buying up shares. They also placed their own bets in the form of options, i.e. a reservation to buy the stock at an agreed upon price at a later date. Now if one kid on Robinhood decides to bet that GameStop, which was trading at $18.84 on New Year's Eve, will be above $100 on January 25, no one cares. But if a hundred thousand kids do it, you get this.

There is no one on earth who thinks GameStop is worth $451/share! Some people are making a short term bet that the stock will continue to go up and they'll be able to find someone else to sell it to, some people are in it for the LULZ, and some people are having a great old time in quarantine fucking with a hedge fund. They're already making plans to do the same thing to Bed Bath & Beyond, which is getting murdered by Amazon, and AMC, which is getting murdered because who the hell is going to pay to sit next to a bunch of strangers for two straight hours?

GameStop, BlockBuster, Bed Bath & Beyond, AMC… it’s like some kids remembered their favorite places in the mall 20… https: //t.co/HiSTvHvaai

— Mike Murphy (@Mike Murphy) 1611760468.0

The hedge funds are, understandably, freaking the fuck out. They thought there were rules to this game and they had paid a bunch of math majors to generate equations and models quantifying the risk. Now a bunch of Dumb Money dickheads in a chatroom are fiddling with the knobs, and they have to fork over $400/share for a piece of shit stock they bet was going to go down to $10. They're demanding the SEC investigate, calling this a pump and dump scheme. Which ... well, it kind of is. It's also kind of a tulip mania crossed with a gleeful act of vandalism perpetrated by thousands of people at once, and anyway who the hell are you going to arrest?

The hedge funds, which are run by truly unsympathetic figures right out of The Great Gatsby, are busy bailing each other out. And the stock market is going haywire, because a mob of people is exploiting loopholes that were left open with the express purpose of letting just a few people exploit them and get fabulously rich. And now Robinhood and E-Trade have shut down buying GameStop and AMC (you can still sell), purportedly to protect their unsophisticated customers from losing their shirts when this whole thing crashes. Which it already is — it's declined to $196 since I started typing! — and whichever Dumb Money kid is unlucky enough to be the last one holding these crap stocks is going to be totally hosed.

This is unacceptable. We now need to know more about @RobinhoodApp’s decision to block retail investors from purch… https: //t.co/tTVEZYkuXN

— Alexandria Ocasio-Cortez (@Alexandria Ocasio-Cortez) 1611851784.0

But it beggars belief to suggest that they're tripping the breaker to protect the kids. This is about the big money guys, and we all know it. Because capitalism is great and the free market is unerring, right up until rich guys start getting fucked. Then socialism and market controls start to look pretty good!

And also ...

KNOCK IT OFF, YOU GUYS! We're in the middle of a pandemic, there's massive unemployment, and we need Wall Street's buy-in to dig us out of the giant hole Trump left us in. The past four years seem to have finally brought us to a national consensus that we have to do something about climate change, systemic poverty, and racial injustice. There is a seriousness of purpose as we all disengage from the 24-hour, Twitter-fueled rage cycle, and President Biden is trying to enact a progressive agenda with the narrowest of congressional margins. The last fucking thing we need is someone jumping up and down in the SS Minnow sloshing water all over Thurston and Lovey Howell.

I, too, think that the existence of billionaires is a gross, moral failure that should be remedied by massive changes to the tax code. But that's not on the menu today. Today, Biden is trying to backdoor us into a bolsa familia- style payment scheme for poor families and convert the federal fleet to electric vehicles, and, frankly, we do not have time for this foolishness. And, oh by the way, if you want a bunch of luddite septuagenarians in the Senate and nihilist millennials in the House breaking social media to "fix" Section 230, this is a really good way to make it happen!

In summary and in conclusion, everyone in this story is an asshole who needs to cut it out. The end.

[ NYT / Popular Info / Bloomberg ]

Follow Liz Dye on Twitter RIGHT HERE!

Please click here to support your Wonkette. And if you're ordering your quarantine goods on Amazon, this is the link to do it.

One of the Spawn asked me which company I thought would be good for buying stock. I had just finished reading about the GameStop and could feel my mom signal start flaring. Sure enough! Instead of reacting "are you out of your fucking mind??!", I sent articles on pump and dump schemes and a link to a newsletter for first time investors. :D

Don't feed the troll. Not worth your time