GOP Tax Plans Are Just Free Stuff For Rich People: A Wonksplainer

A rising tide lifts all yachts.

Are you rich and tired of all the poors getting the government handouts? Damn right you are! It’s time that this country gave something back to rich entitled asshats, and the GOP clowncar of fuckwits and addle-brained toads are determined to finally wrestle power and prestige away from the 99% and give the rich the tax breaks that they absolutely don’t deserve but really really want, like a pouty millennial and a corner office.

We’ve already covered the wrongheaded unicorn-fart-inspired tax plans from Jeb(!) , Grown-up Richie Rich Donald , and “Doctor” “Ben” “Carson.” Let’s sum those up for you:

Poors: Chump change.

Middle Class: Hahahaha, suck it losers.

Rich: ALL THE MONIES!!1!!1!

There’s not a lot of difference between the plans of the other 84 Republicans running for President. But rather than rip each one individually , let’s learn about some of the dastardly ways that Republicans use the tax code to make it rain for their fatcat donors!

The Basics, Morans

The government collects taxes from all of us in a variety of ways. We have a progressive income tax structure, meaning that taxes gradually go up as you make more monies. These are the taxes we file in April. We also pay taxes like Social Security and other stuff each time we get paid, and that goes straight to the Treasury. Businesses pay taxes, but since we are not a business owner like the Editrix, we have no idea how that works, other than to say that taxes MUST be paid at a certain rate. The government collects these monies and spends all of it buying lobster & steak for that one guy on food stamps that your asshole uncle saw at the grocery store that one time because anecdotes equal reality.

In the simplest of worlds, taxes would be paid, and then tax money would be spent.

The Democratic Approach: Spend It If Ya Got It

Dems like to spend the monies collected to help lots of people have a better life. This includes expenditures on things like education, food stamps, welfare, saving the environment, roads, bridges, infrastructure, Obamaphones, health care for EVERYONE, Planned Parenthood , and all the other liberal good shit we support. When looking at a budget, this counts as spending: Government takes money from everyone, then spends it on stuff that benefits society as a whole. As people are healthy and educated, they get jobs, pay their fair share of taxes, and everyone benefits.

Dems rely on money collected from everyone, which is why Dems sometimes want to raise taxes on the top 1%, so that programs that help the 100% can be funded. Taxes are not seen as an evil, but as the price everyone contributes for membership in an actual first-world nation. This worked pretty well in the 1950s, for instance.

The GOP Approach: Bitch BetterHave MyTake Our Money

The Republicans prefer to give money away on the front end, rather than spend it on the back end. For example: Imagine Douchebag McRicherson owes $1 million in taxes. A Republican will provide loopholes wider than Chris Christie's baseball pants to reduce that amount to as little as possible. Got a yacht? Have a tax deduction! Second home in the Hamptons? Write off that mortgage as a tax deduction! Make enough money to max out your 401k? Make it tax-free! Make even more and want to set aside money for your kid’s college? Don’t pay taxes there, either! It’s like Oprah Winfrey, except the “cars” given away are tax dollars owed to the government that never get paid. And the rest of us are left footing the bill. And yes, there's still a bill, because you can't actually rely on the free market to make a complex nation run all on its own.

Why All This Matters

All governments everywhere pick winners and losers. Here in Merica, winners and losers are chosen through BOTH spending decisions AND the tax code.

When bloviating piles of pig phlegm like Ted Cruz vomit words from their mouth-holes about reducing spending, they are specifically and intentionally drawing the media attention away from GOP priorities (give-aways to the rich) and focusing on Democratic priorities (spending that helps the majority of people).

When GOP candidates put forth tax plans that repeal the estate tax or remove capital gains tax, they are adding to the deficit and reducing the amount of money the government has to spend on programs. Rather than the government having the aforementioned $1 million in taxes, Douchebag McRicherson is only paying like $30. The GOP has taken money owed to the American people and given $999,970 to Douchebag.

Scholars call this “ tax expenditures. ” This money could be used to pay down the debt, fight the next war over oil, or rebuild collapsing bridges. Instead, Douchebag McRicherson will use Benjamins to light cigars while laughing at us schmucks.

But Food Stamps Are Still The Real Problem, Right?

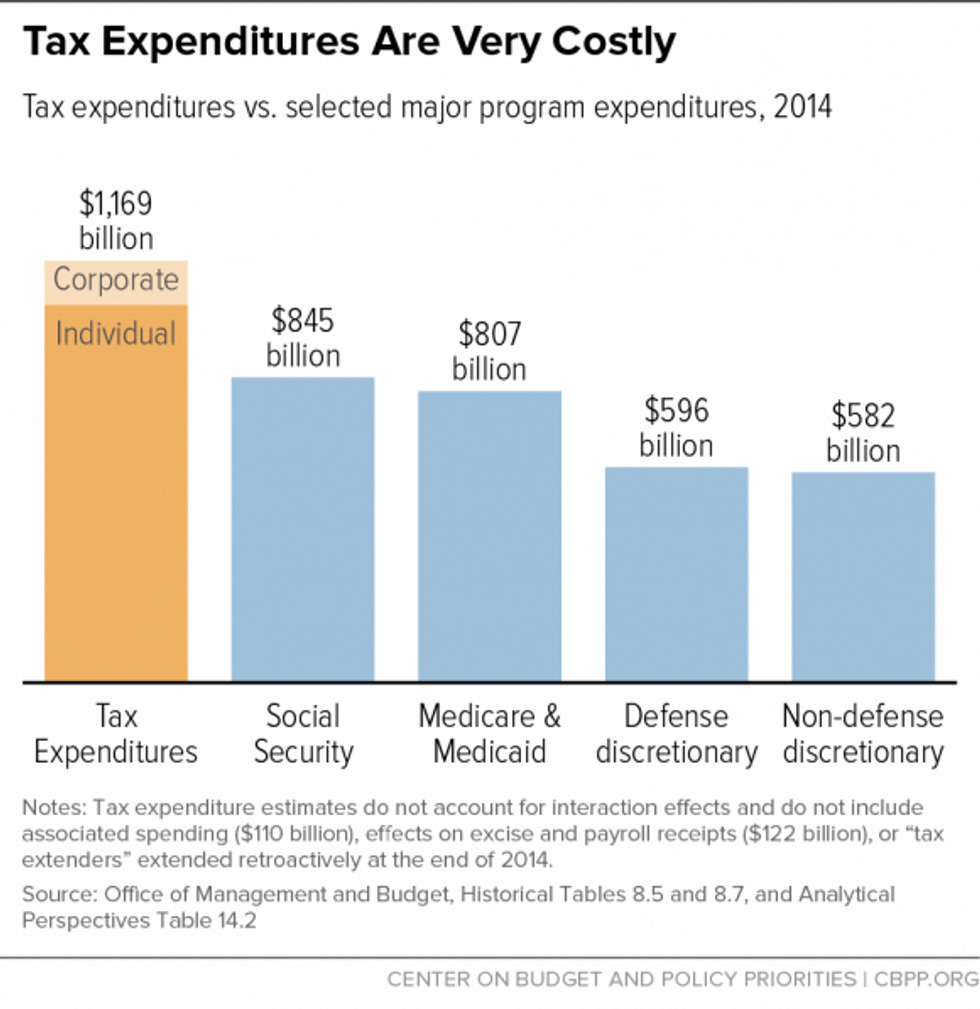

All the good social programs that progressives care about fall under the category of “non-defense discretionary” spending, which is around $582 billion per year. In 2014, tax expenditures equaled $1.17 TRILLION. See, here is a nifty chart from the Center on Budget and Policy Priorities (CBPP) :

Let's put this in perspective: the budget deficit in 2014 was $483 billion. This means that if we closed every tax loophole and giveaway in 2014, the U.S. would have had a budget surplus of more than $680 billion.

But Poors Benefit From Tax Expenditures, Too, Right?

Yep, you are correct. For the ten largest federal individual income tax expenditures by income group (in 2013), the bottom 20% of Americans received a whopping 7.7% of the benefits. The top 20%? They got treated to a mere 50.6% of the benefits, as is only just and fair. If you look at just the top 1%, they get almost 17% of the benefits. Maybe they'll hire some people! We'll let CBPP explain:

As a result, these tax expenditures provide their largest subsidies to high-income people, even though they are the individuals least likely to need financial incentives to engage in the activities that tax expenditures are generally designed to promote, such as buying a home, sending a child to college, or saving for retirement. Meanwhile, moderate- and low-income families receive considerably smaller tax-expenditure benefits for engaging in these activities.

This is why, according to Vox (and math), Republicans increase these types of rich-person welfare at a MUCH higher rate. See, look at this other cool (but depressing) chart:

Tax expenditure benefits mirror the benefits of the tax plans put out there by Republicans. Massive benefit to those at the top of the income scale, drastically dropping off as incomes decrease. In the GOP world, free shit rolls uphill .

Regular old shit? That still falls off the bootstraps of the rich and right in our faces.

[ Washington Post / Vox / Center on Budget and Policy Priorities ]

So you're taking a wait and see attitude here?

Keith Richards.

(drops mike)

(picks mike back up)

Holy shit, I just saw the bottom of your post, how in the hell did 'Philthy Animal' die? Wow, why havent I seen this anywhere else on the web? Wow, that takes me way back to high school and my speed metal/punk/thrash days...

Have a great day!

PS Love Lemy's quote: 'Now he's died and it really pisses me off that they take somebody like him and leave George Bush alive'