Amercia, Where You Are Free to Take On Crushing Lifelong Debt

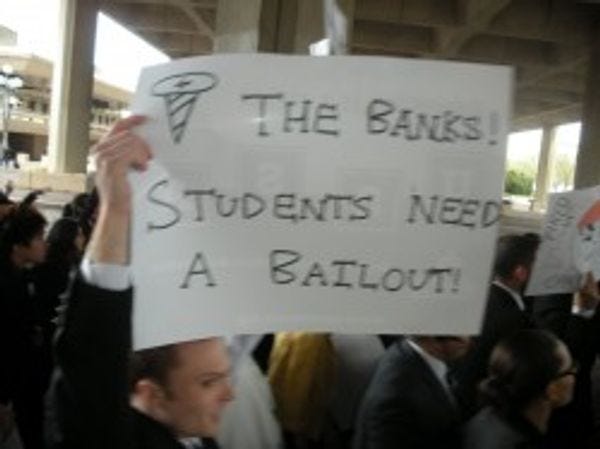

Wonketteers are all latte-drinking Prius-driving libruls, so they are all probably avid New York Times readers who are very familiar with the Times' ongoing series on income inequality, "The Great Divide." But just in case! Today's installment is a cheery essay by Joseph Stiglitz, titled "Student Debt and the Crushing of the American Dream." Doesn't that sound like a fun read? According to Stiglitz, Amercia is being ruined forever by student loan debt, because Poors have the audacity to think they can improve their socio-economic statuses by taking on crushing debt and getting an education. This, of course, is a myth: a law passed in 2005 made it basically impossible to discharge student loan debt , and so it stays with you always like herpes, or a bad tattoo, except worse because you still have a chance at happiness of you have herpes or a bad tattoo. Also, going to college and taking on a bunch of crushing debt may not necessarily get you a good job, since almost half of all college graduates have jobs that do not require a college degree, but they still have to make payments on these debts with their meager salaries, so they can't afford to go out to eat or go on frivolous shopping excursions, so our economy suffers, so there are no jobs for college grads, and round and round we go! Here, let Joseph Stiglitz explain all this at you in fancier language and using more "facts."

Via the New York Times:

According to the Federal Reserve Bank of New York, almost 13 percent of student-loan borrowers of all ages owe more than $50,000, and nearly 4 percent owe more than $100,000. These debts are beyond students’ ability to repay, (especially in our nearly jobless recovery); this is demonstrated by the fact that delinquency and default rates are soaring. Some 17 percent of student-loan borrowers were 90 days or more behind in payments at the end of 2012. When only those in repayment were counted — in other words, not including borrowers who were in loan deferment or forbearance — more than 30 percent were 90 days or more behind. For federal loans taken out in the 2009 fiscal year, three-year default rates exceeded 13 percent.

Perhaps the students should have thought of that BEFORE they took out crushing amounts of debt to pursue the American dream, hmm? Or maybe they could have simply decided to only get the amount of education they could afford. Or MAYBE, just MAYBE, they could have learned MySQL or Javascript and skipped college altogether, is that too much to ask?

Average tuition, and room and board, at four-year colleges is just short of $22,000 a year, up from under $9,000 (adjusted for inflation) in 1980-81.

Compare this more-than-doubling in tuition with the stagnation in median family income, which is now about $50,000, compared to $46,000 in 1980 (adjusted for inflation).

Maybe the Median family could just start a thriving bootstrap business, or perhaps go into hedge funds, like the Romneys. By the way, let us add that the Federal Funds rate has been less than 1% for the past few years now. Meaning: the Federal Reserve lends money to banks at an interest rate of less than 1%. The banks then turn around and lend this money to students at 3.4%.

As bad as things are, they may get worse. With budgetary pressures mounting — along with demands for cutbacks in “discretionary domestic programs” (read: K-12 education subsidies, Pell Grants for poor kids to attend college, research money) — students and families are left to fend for themselves. College costs will continue to rise far faster than incomes. As has been repeatedly observed, all of the economic gains since the Great Recession have gone to the top 1 percent.

Oh goody, they can get worse? How interesting, we can't wait to see what happens.

that or work as a stripper

that would have been some must-see TV