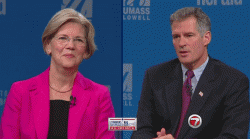

Elizabeth Warren Hands Ben Bernanke His Own Ass

Hi Lizzz! HIIIIIII! WE LOVE YOU!!!! Why? Well, in addition to the usual reasons, Ben Bernanke appeared in front of the Senate Banking Committee yesterday, and Elizabeth Warren basically asked him stuff like: Why is everything still so horrible, Ben? Why are you doing absolutely nothing to fix anything, Ben? Why are you just standing there with your dick in your hand while the banks crap all over the American people, Ben? If you love the banks so much, why don't you marry them, Ben?

"We've now understood this problem for nearly five years," she said. "So when are we gonna get rid of 'too big to fail?'"

Warren also asked whether big banks should repay taxpayers for the billions of dollars they save in borrowing costs because of the credit market's belief that they won't be allowed to fail, repeatedly citing a recent Bloomberg View study estimating that the biggest banks essentially get a government subsidy of $83 billion a year , nearly matching their annual profits.

...[Bernanke] said the market was wrong to give banks any subsidy at all (in the form of lower borrowing costs), insisting that the government will in fact let banks fail. The 2010 Dodd-Frank financial reform law has given policymakers the tools to safely shut down big, failing banks, he claimed.

Do we need to tell you that Bernanke is full of horseshit? Probably not, so we will let other people tell you instead: here is Roberta Karmel, Professor at Brooklyn Law School and former SEC Commissioner, explaining (among other things) that Dodd-Frank is too weak to break up big banks. Here is an op-ed explaining why regulations of the Securities and Exchange Commission have been challenged six times in the federal court of appeals in Washington, D.C, and the SEC lost every time. Oh and look, here is Jamie Dimon, explaining that Dodd-Frank actually helps big banks get more of the market share.

So anyway, Dodd-Frank: better than nothing (maybe? although possibly not?) but not good enough by a long shot. It's cool though, Liz has our backs.

But when repeatedly pressed by Warren, Bernanke's confidence seemed to waver.

"The subsidy is coming because of market expectations that the government would bail out these firms if they failed," Bernanke said. "Those expectations are incorrect. We have an orderly liquidation authority. Even in the crisis, we -- uh, uh -- in the cases of AIG, for example, we wiped out the shareholders..."

"Excuse me, though, Mr. Chairman," Warren said. "You did not wipe out the shareholders of the largest financial institutions, did you, the big banks?

"Because we didn't have the tools," Bernanke replied. "Now we could -- now we have the tools."

See, NOW they have the tools, so it's cool, yo. NOW they have the tools, so the NEXT time the banks crash the economy, well, those shareholders should totally watch out! Because he will be coming to get them with the tools, probably! Or maybe! At some point -- not right away, these things take time, OK? They take time! But when that time comes, man, watch out! Because Ben Bernanke will be there with the tools!

Later, when pressed again by Warren, Bernanke suggested that the government's tools to wind down a big bank that is failing were still a work in progress -- or at least that financial markets have not yet been convinced of their power.

"Some of these rules take time to develop -- um, uh, the orderly liquidation authority, I think we've made progress on that," he said. "We've got the living wills -- I think we're moving in the right direction ... We do have a plan, and I think it's moving in the right direction."

"Any idea about when we're gonna arrive in the right direction?" Warren said.

"It's not a zero-one kind of thing," Bernanke stammered in response. "Over time we will see increasing, uh, increasing market expectations that these institutions can fail."

He later added, "As somebody who's spent a lot of late nights dealing with these problems, I would very much like to have confidence we can close down a large institution without causing damage to the economy."

He would like to, but he doesn't, which we already knew, but it's nice that he was finally able to admit it. Except -- and this is going to really help you sleep better, we promise -- he has a plan, OK? The plan is that the banks will WANT to stop being so big, and then they'll stop being so big, and then yay! They won't be so big and USA! USA! (No really, this is kind of what his plan is.)

Bernanke suggested that banks would eventually lose some of the benefits of size and would shrink themselves voluntarily.

Size doesn't matter, Jamie Dimon, haven't you heard?

Meanwhile, the big banks are benefitting pretty nicely from their size! Did you know, for example, that Wall Street banks paid out nearly $122,000 in bonuses per banker last year , which is almost three times the American median household income? The last time bankers took home bonuses that were less than the median household income was 1991. This is because banks, as Jamie Dimon helpfully explained, are "anti-fragile," and benefit from economic downturns. And truer words were never spoken, really, given that the economic downturn has been gravy all day for JP Morgan! They get taxpayer subsidies! They got to buy Bear Stearns in a fire sale! They got billions of dollars in TARP funds! The economic downturn has been AWESOME! And next year, it will be EVEN MORE AWESOME for JP Morgan, because they will be laying off 15,000 people and saving $3,000,000,000. And boy, we can't wait for that $3,000,000,000 to trickle down on us like a golden shower!

I've met Kranz, he's a great speaker out on the lecture circuit these days. Good guy, he still wears the vest...

it's not like that is the exact opposite of what every single theory on the nature of capitalism predicts..