Persecuted Job Creators Not Being Taxed To Death By States, Don't Worry

We have heard so very much about how mean this country is to rich folks. They are so very considerate of the rest of us, keeping our economy going and investing and spending, instead of just sinking Manhattan and fleeing into space in that Red Bull hot-air balloon. The wealthy folks keep us going, the story goes, and how do we repay them? WITH HIGHER TAXES.

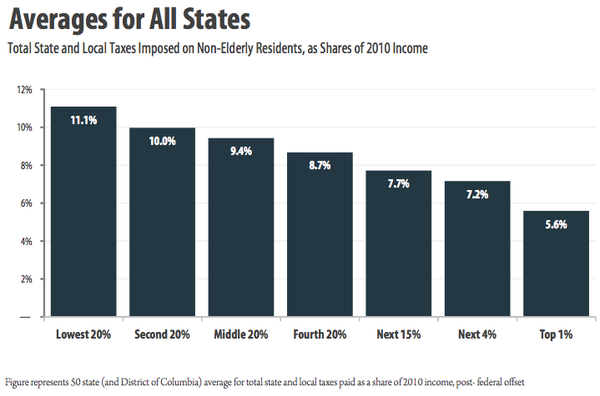

It's terrible! We punish success, we really do, by suggesting that maybe the wealthy can afford to pay a higher proportion of their income than poor people. It's disgusting. So if you heard a think tank just put out a report that included a graph of average taxes levied by states for the various income brackets, you would expect the end with the rich people to be SO HIGH, right?

You would think, but actually, it's exactly the opposite!

Indeed — the Institute on Taxation & Economic Policy has put together estimations based on income, property, and sales/consumption taxes, and made pretty graphs like this one :

Look at that thing! Look at the percentages! The nation's top 1 percent pay, on average, half the proportion that the bottom 20 percent pays!How socialist.

That's what the report says, right? That the American tax system nurtures a culture of dependence, and rewards being a bum?

The main finding of this report is that virtually every state's tax system is fundamentally unfair, taking a much greater share of income from middle- and low-income families than from wealthy families.

Oh. Well what about awesome states like Florida, which doesn't even have an income tax?

Sales and excise taxes are the most regressive, with poor families paying eight times more of their income in these taxes than wealthy families, and middle income families paying five times more.

Wait, you mean replacing a state's income tax revenue with a flat consumption tax affects people who have to spend every dime more than people who make gobs of money?

Startlingly, yes! And systems like that also result in wildly regressive tax ratios on the state level — including, yup, Florida.

According to the report, the poorest 20 percent of Floridians pay about 13.2 percent of their income on state taxes — the richest 1 percent pay a 2.3-percent rate, likely due to their awesome system where there is no income tax but it costs like $40,000 to register your car.

And they are not even the worst ones:

It's their own fault, really. If people want to pay a smaller proportion of their income in taxes, they should just have more money . They should pull themselves up by their bootstraps — but not before paying the sales tax on those straps — nice try, freeloader.

[ ITEP ]

If there's no slack in your mooring line, a rising tide leaves you underwater.

He also said it on the op-ed page of the NY Times a few days ago, with particular reference to "Bobby" Jindal's plan to improve Louisiana's ranking in that table. He's mostly just preaching to the choir, though.