World Astonished That Stock Index Falls During Historic Financial Crisis

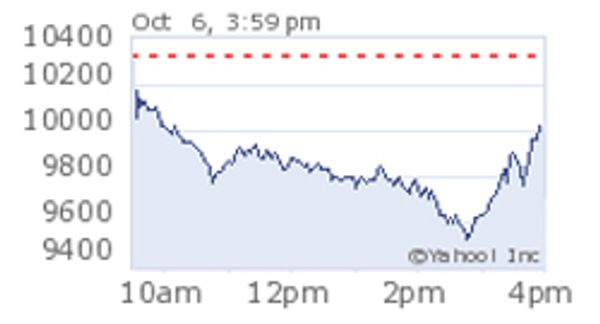

Well here is your updated Dow Jones thing, about which every "person on the Internet" today has been freaking. It went down like 350 points after a far greater initial plunge. This has baffled many, many people today, that this stock index fell triple-digits on a day when every remaining bank on Earth basically failed.

The growing trend among every blogger of every background is to preface a post with, "Now I'm not exactly an economics expert" or "This is a bit above my pay grade," and then launch into a multi-paragraph armchair rant about credit-default swaps, mark-to-market accounting rules, the role of the derivatives, things like that (pretty much copy-pasted from a Wall Street Journal guest op-ed), and then to finally conclude "THE DOW IS IN FREE FALL AGHHHHH WAAHHHHH."

This is not helpful. We will try to explain this in simple terms even though this is above our pay grade, as we are paid to write about real-world objects vaguely related to politics that happen to look like penises, vaginas, or poop:

1) A lot of banks made bad housing loans. A lot of financial people bought up these bad loans. A lot of people insured these bad loans. Add several more layers on a global scale.

2) Housing prices fell.

3) Much wealth was lost.

This actually happened, and it has a lot to do with why we're digging into a deep global recession! On Wall Street, this means asset values... drop! They drop and drop and drop, because no one has much money or credit, and then everyone sells because they're going to keep dropping dropping dropping. And then when the Dow has dropped 800 points, Wall Street says to itself, "Whoa, 800's a lot, so now we buy shit?" So it only ends down 350 points -- manageable! -- and people pretend for another day that maybe our economy won't contract during a recession, definitions and comeuppance be damned.